The global market for specialty fuel additives is expected to reach USD 8,517.6 million by 2020, according to a new study by Grand View Research, Inc. Dynamic regulatory trends, particularly in North America and Europe has prompted fuel marketers to use specialty fuel additives which is expected remain a key driving factor for the market over the forecast period. In addition, ban on MTBE in the U.S. is expected to further push the demand for fuel additives over the next six years. However, emergence of alternative fuel such as autogas (LPG) and CNG owing to eco friendly characteristics is expected to hamper the market growth over the next six years.

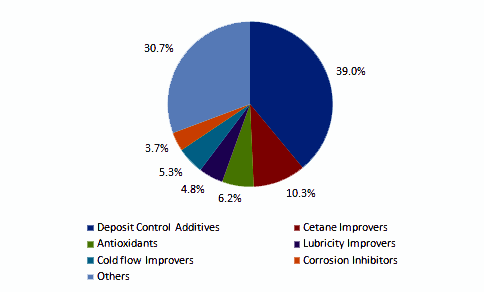

Deposit control additives emerged as the leading market products and accounted for 39% of total global volume in 2013. Increasing demand for detergent as an additive is expected to fuel the demand for deposit control additives over the forecast period. However, cold flow improvers are expected to be the fastest growing product segment at an estimated CAGR of 7.9% from 2014 to 2020. Positive outlook on biodiesel demand, especially in regional markets of North America and Europe is expected to boost cold flow improver sales over the next six years. The global demand for cetane improvers is projected to reach 209.6 kilo tons by 2020, at an estimated CAGR of 5.7% from 2014 to 2020.

View

summary of this report @ http://www.grandviewresearch.com/industry-analysis/specialty-fuel-additives-industry

Global specialty fuel additives market volume share by product, 2012

Further Key findings from the study

suggest:

- The global market for specialty fuel additives was 1,383.4 kilo tons in 2013 and is expected to reach 2,066.4 kilo tons by 2020, growing at a CAGR of 46% from 2014 to 2020.

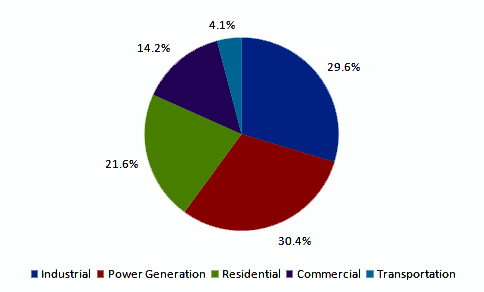

- Gasoline dominated the global application market for specialty fuel additives, accounting for 46.2% of total market volume in 2013. High gasoline demand, mainly in the U.S. is expected to drive the demand for specialty fuel additives used in gasoline. However, owing to surging demand for ULSD, diesel is expected to surpass gasoline to emerge as the leading application market for specialty fuel additives by 2020. On the aforementioned factors, diesel is also expected to be the fastest growing application market for specialty fuel additives at an estimated CAGR of 6.5% from 2014 to 2020.

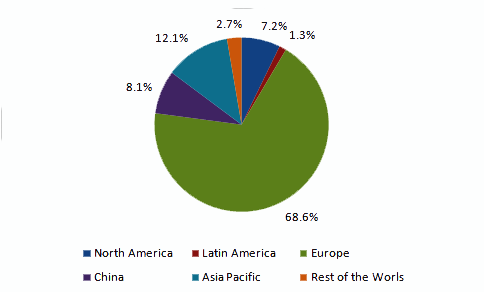

- North America dominated the global market for specialty fuel additives and accounted for 27.8% of total market volume in 2013. Clean fuel program initiated by the U.S. EPA is expected to drive the regional demand for specialty fuel additives. However, rapid strides by countries such as India and China in fuel consumption are expected to turn Asia Pacific as the most attractive market which is projected to grow at an estimated CAGR of 7% from 2014 to 2020. In addition, Asia Pacific is expected to surpass North America to become the largest market for specialty fuel additives by 2020.

- Global market for specialty fuel additives is moderately concentrated with top four companies including NewMarket, Innospec, BASF and Infineum accounting for 48.5% of total market in 2013. Other companies operating in the global specialty fuel additives market include, Lubrizol, Baker Hughes, Chevron Oronite, Albemarle, Chemtura, Clariant, Dow Chemical Company, Evonik Industries, Eurenco, Total Additives & Special Fuels, Dorf Ketal and NALCO Champion among others.

Browse All Reports of

this category @ http://www.grandviewresearch.com/industry/conventional-energy

For the purpose of this study, Grand View Research has segmented the global specialty fuel additives market on the basis of product, application and region:

Global Specialty Fuel Additives Product Outlook (Volume, Kilo Tons; Revenue, USD million)

• Deposit Control Additives

• Cetane Improvers

• Antioxidants

• Lubricity Improvers

• Cold Flow Improvers

• Corrosion Inhibitors

• Others

Global Specialty Fuel Additives Application Outlook (Volume, Kilo Tons; Revenue, USD million)

• Gasoline

• Diesel

• Aviation Turbine Fuel (ATF)

• Others

Specialty Fuel Additives Regional Outlook

• North America

• Europe

• Asia Pacific

• Middle East & Africa

• Latin America

About Grand View

Research

Grand

View Research, Inc. is a U.S. based market research and consulting company,

registered in the State of California and headquartered in San Francisco. The

company provides syndicated research reports, customized research reports, and

consulting services. To help clients make informed business decisions, the

company offers market intelligence studies ensuring relevant and fact-based

research across a range of industries including technology, chemicals,

materials, healthcare and energy.

Contact:

Sherry

James

Corporate

Sales Specialist, U.S.A.

Grand

View Research, Inc.

United

States

Phone: 1-415-349-0058

Toll

Free: 1-888-202-9519

Email: sales@grandviewresearch.com

Blog

Site: http://www.divog.org/