The global installed capacity for solar PV is expected to reach 489.8 GW by 2020, according to a new study by Grand View Research, Inc. Growing push for sustainability has led to increased focus on renewable energy forms such as solar PV. In addition, favorable regulatory policies such as Feed in Tariff (FIT) is expected to further increase installed capacity, particularly along the Sunbelt countries. The reduction in price of PV modules is expected to lower the cost of energy generated by solar PV to USD 0.07 – USD 0.16, making it competitive to oil or gas fired peak power plants.

Countries with large PV potential such as Brazil, Chile and Saudi Arabia have not expanded as expected and this is expected to hamper the development of the market over the next six years. Aggressive capacity addition, particularly in China is expected to make the market oversupplied resulting in further lowering of prices. Product differentiation and innovation is extremely crucial with companies diversifying in both upstream and downstream markets, with expansion in project development and building strategic partnership. There are widespread opportunities in the form of new emerging markets and the link between reduced prices and unlocking of new markets is expected to be the key to market development.

View

summary of this report @ http://www.grandviewresearch.com/industry-analysis/solar-pv-industry

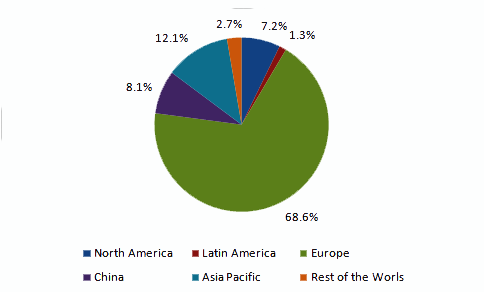

Global Solar PV installed capacity, by region, 2012

Further Key findings from the study

suggest:

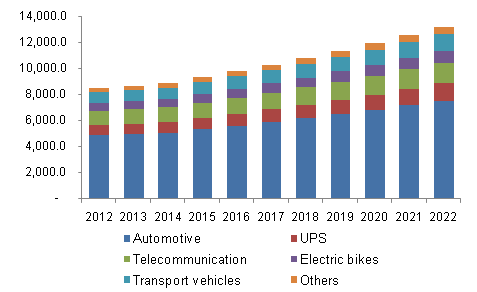

- Utility scale solar PV was the largest end use segment for the solar PV market and accounted for over 45% of the global installed capacity. This segment is also expected to witness fastest growth on account of the growing need for power coupled with competitive prices offered by solar PV modules for power generation.

- The use of solar PV for non residential application is also expected to show significant growth over the next six years with major Sunbelt countries looking to harness the potential of solar energy and employ it as a substitute to conventional forms of energy. The segment is expected to grow at a CAGR of over 20% from 2013 to 2020.

- Europe had the largest installed base of solar PV in 2012 primarily due to installations in countries such as Germany, Italy, Spain and France. The total installed capacity for Europe exceeded 70 GW as of 2012. However, the region is expected to lose share owing to the rapid development of solar PV market in China and countries of Asia pacific such as India, South Korea, Taiwan and Australia.

- China is expected to show the fastest growth over the next six years due and is expected to grow at a CAGR of over 35% from 2013 to 2020. The regulatory support in the country in addition to the low cost of raw materials is expected to fuel the aggressive development.

- Yingli Green Energy (China) and First Solar (USA) are two of the largest companies operating in the market. The other key companies manufacturing solar PV systems include Canadian Solar, Sharp, REC, Trina Solar and Hareon Solar among others.

Browse All Reports of

this category @ http://www.grandviewresearch.com/industry/energy-and-power

For

the purpose of this study, Grand View Research has segmented the global solar

PV market on the basis of end use and region:

Solar PV End Use Outlook,- Residential

- Non Residential

- Utility

- North America

- Latin America

- Europe

- China

- Asia Pacific

- Rest of the World